Spotlight on... Middle East

- Fosca D'Incau

- Nov 30, 2016

- 4 min read

A future ‘Saudi Spring’?

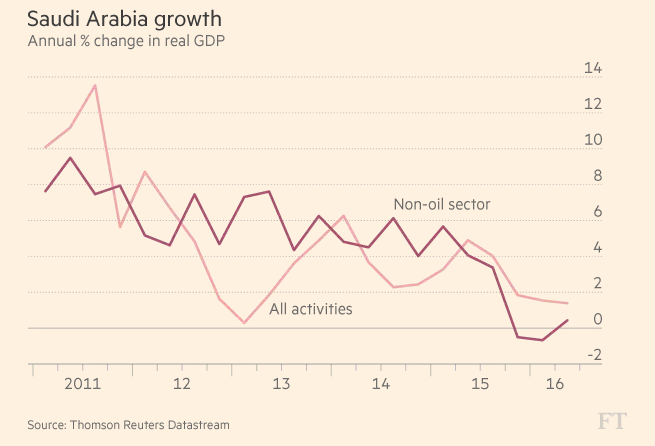

Saudi Arabia’s economic growth has been weakening since 2015 with revenues in steady decline due to low oil prices and rising military expenses associated to the air campaign conducted in Yemen. The Middle East’s largest economy is on the brink of its first non-oil sector recession in 30 years, with non-oil growth down from 3.5 to 0.07 per cent from last year. According to Moody’s, who downgraded Saudi Arabia’s credit rating last May, government finances have also deteriorated significantly with a recorded deficit of 14.9% of GDP in its fiscal balance in 2015, compared to one of 2.3% in 2014. Prince Salman’s government has applied austerity measures with delayed government debt repayments and cuts to public sector workers’ benefits of $14 billion in September, which have hit consumer spending and business confidence.

Prince Salman has put forward plans for economic diversification with an ambitious reform programme aimed at reducing Saudi dependence on oil revenues and developing its private sector. The transformation plans, laid out in the ‘Vision 2030’ and the ‘National Transformation Plan’ documents, identify hundreds of initiatives to adjust the Kingdom to a post-oil era. This initiative will cost the government $72 billion this year. In addition, progress is intended to be made on privatisation and public-private partnerships, which could also spark dissent in a country where the population has been heavily relying on the state’s subventions. Saudis understand the impact of low oil prices on the need for reform; however, the means and pace of transformation could be the fuel of dissent. The prospect of further cuts to oil subsidies and pensions associated with the expensive intervention in Yemen and Prince Salman’s excesses with his latest acquisition of a new super yacht for €500 million, is sparking discontent among the population and creating the prospect for a ‘Saudi Spring’.

In the context of the 2011 Arab Spring, Riyadh managed to remain fairly excluded by the wave of protests raging around the Middle East mainly due to the economic benefits provided to its citizens. With the current economic crisis the Saudi government is facing, will it be able to avoid protests to spark for much longer?

An opportunity for the Middle Eastern aluminium industry to bloom

Demand in the United States for aluminium is boosting while production is steadily declining as plants are rapidly closing. Since 1980, U.S. output has dropped from 4.6 million to 700,000 tons in 2016 while the demand of today is about 7.5 million tons a year. This resulted in an opportunity for Middle Eastern producers to fill the gap by boosting metal shipments to the U.S., which rose by 50 percent this year. Electricity costs in the Middle East give vendors an advantage. The cost of production in the region was on average $1,200 a ton this year, compared with $1,670 in the U.S. As of today, the region’s industry consists of six plants in Saudi Arabia, United Arab Emirates, Oman, Bahrain and Qatar with an output of about 5.2 million tons last year. This could be an opportunity for countries in the Middle East to increase their profits and diversify their economies in the face of plunging oil prices.

Trump’s election: Impact on the Middle Eastern oil market

Trump’s victory and the ambiguities associated to his future geopolitical policies have increased uncertainties in an already unstable global energy market with halved oil prices from 2014 averaging now $54.33/barrel. The newly elected President’s stance on deregulating the United States’ energy market and opposing climate change agreements can only result in an increase in hydrocarbons in the international market and a consequent further plunge in oil prices in the long term. On the other side, Middle Eastern oil producers have been pushing to set global restrictions on hydrocarbon’s production in order to increase and stabilize prices. The newly elected U.S. President’s campaign policies, such as pulling out of the Paris climate accord, removing restrictions on drilling in the Arctic and the Gulf of Mexico and moving toward energy independence, could therefore damage U.S. relations with OPEC members. Trump’s claim of annulling the Iran nuclear deal can also have an impact in increasing the volatility of the energy market by delaying Iran’s return to the global oil markets and reducing investments in the oil industry in the country. Such policies could therefore contribute in antagonising OPEC members and Iran at a time where cooperation is vital in the context of ending the Syrian proxy war.

Israeli settlement bill: more violence ahead in the West Bank?

On Sunday the 13th of November, the Israeli ministerial committee for legislation has unanimously approved a bill which would retroactively authorise Jewish settlements in the occupied West Bank. If ratified by the Supreme Court, the confiscation of privately owned Palestinian land in exchange for compensation would be legalised. The bill was put forward by far-right party The Jewish Home led by Naftali Bennett, who said that Trump’s victory provided Israel with an ‘opportunity’ to support settlements and reject the legitimacy of the existence of a Palestinian state. The draft legislation came as a response to delay the Supreme Court’s order requiring Jewish settlers to evacuate Amona, a settlement in the northern West Bank, by the end of the year. The draft legislation is not only illegitimate under International Law but, if approved, will also certainly contribute to a renewal of violence in the West Bank as well as in Jerusalem, with an additional Israeli revival of plans to build 500 homes for settlers in the Eastern part of the city.

About Fosca D'Incau

I am a postgraduate student in the MSc in Conflict Studies degree with a focus on the impact of the media on political processes. I did my undergraduate degree in International Relations with a specialisation in the Middle East at King’s College London. I am also currently the Publications Director of PRIS. I am particularly interested in political risk assessments regarding Latin America and MENA. I speak Italian, French, English, Spanish and I am learning Arabic.

Comments